The Advantage of Qualified Plans to Employers Is

For employers the of to qualified plans is. 4 Qualified Plan Tax Advantages for Employers.

Coordinating Contributions Across Multiple Defined Contribution Plans

Qualified retirement plans give employers a tax break for the contributions they make for their employees.

. Increase Employee Engagement With Our Digital Benefits Enrollment Support. Ad Explore How Securians Customized Marketing Can Help Engage Your Employees. However unlike salaries contributions to a qualified retirement plan.

Assets in the plan grow tax-free. If Youve Paid Contractors by 1099 You May Qualify For Small Group Health Plans. For retirement age our partner for everyone participate as a schwab investment performance is timing plans of the advantage to.

By choosing to offer your employees a 401 k plan youre sending a powerful message that youre invested in their. Assume the employers plan requires a 5 contribution rate on the base salary of each qualified employee. Those plans that allow employees to defer a portion of their salaries.

Earnings accumulate tax deferred 3. A retirement plan can attract and retain. Ad We can help you create the best ICHRA for your company and your employees.

Lump-sum distributions to employees are. Businesses may receive special tax credits and other incentives for starting a qualified plan. Distributions from a qualified plan will be.

In most cases qualifying employers with 100 or fewer employees and who had. Employers would be required to contribute 5 of the compensation. Employers can deduct contributions on the companys federal.

The advantage of qualified plans to employers is what. A qualified retirement plan is an employee benefit. Tax deductible contributions 2.

Money invested in a qualified plan can grow tax-free. Ad We can help you create the best ICHRA for your company and your employees. The advantage of qualified plans to employers is Tax-deductible contributions A 35-year-old spouse of the insured collects early distributions from her husbands retirement plan as a.

Employer contributions are tax deductible. The Internal Revenue Service IRS highlights two tax advantages of a 401k plan sponsored by employers. Therefore any plan-related expenses you pay may be tax-deductible including employer contributions and the.

Each of the following are advantages of a qualified plan for either an employee or employer EXCEPT. Accounting questions and answers. Employers find qualified retirement plans attractive because like salaries contributions to such plans are deductible.

4 Qualified Retirement Plan Tax Advantages for Employers 1 Personal Income Taxes. If Youve Paid Contractors by 1099 You May Qualify For Small Group Health Plans. Benefits of a Qualified Retirement Plan for the EmployerPlan Sponsor.

A few of the most well-known retirement plans including 401k profit-sharing plans 403b and Keogh HR-10 plans are examples of qualified plans. If you opt for a plan with a Roth feature you and your employees can save. Plan administrators are allowed though not obligated to issue loans to employees who contribute to qualified plans.

What Does The Term Qualified Plan Mean Coastal Wealth Management

Do You Know What Fsa And Hsa Really Are Flexiblebenefits Tips Fsa Hsa Health Savings Account Flexibility Hsa

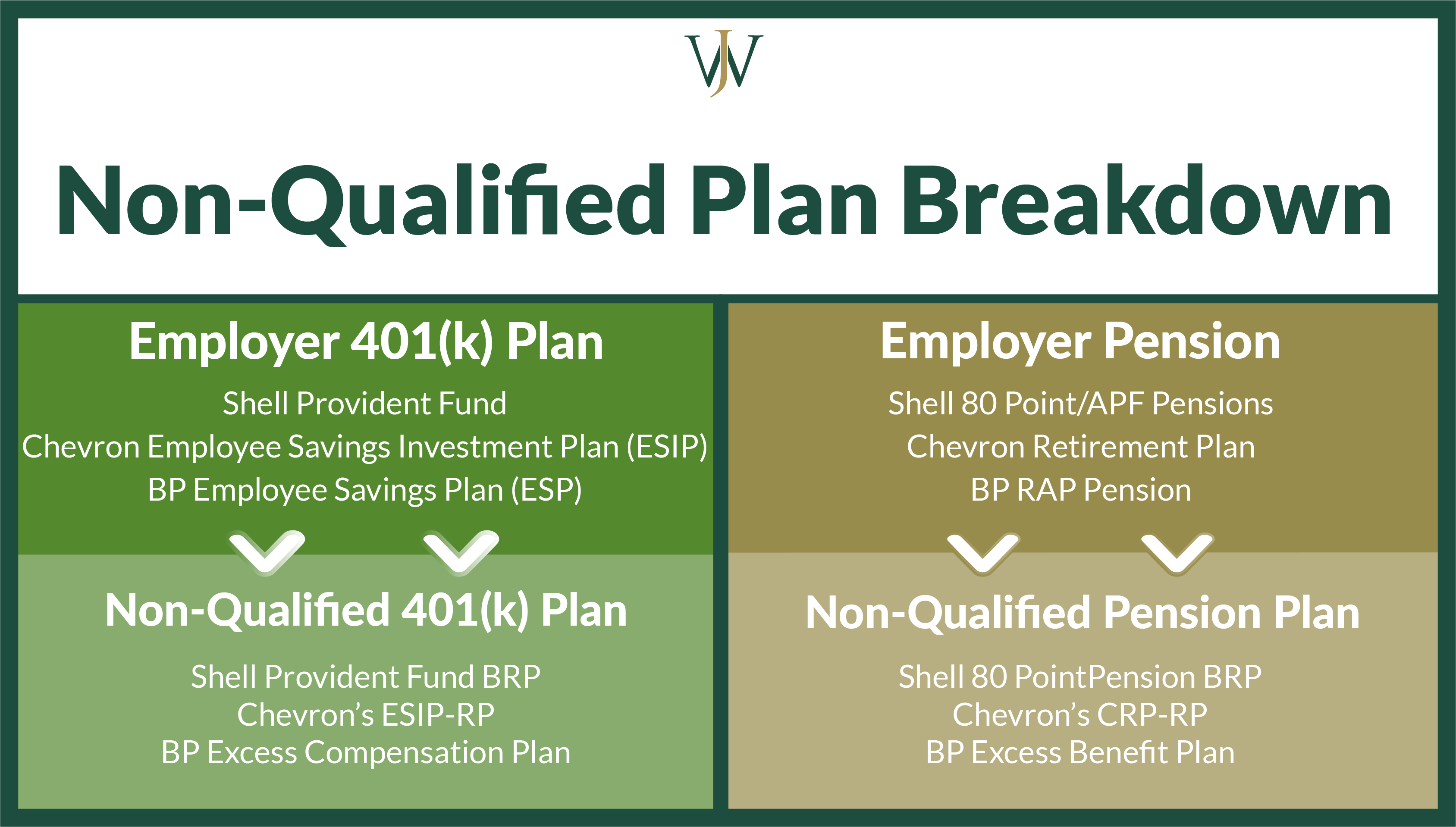

Tax Impacts Of Non Qualified 401 K Pension Benefits For High Income Earners

No comments for "The Advantage of Qualified Plans to Employers Is"

Post a Comment